Last Year in the Markets – January 3rd to December 30th, 2022

What happened in 2022?

Overall, last year was a trying time for almost every Canadian investor. Several factors contributed to the turmoil and difficulty that affected every asset class and investor at some point during the last twelve months. Although a single, isolated event rarely occurs politically, economically, socially, or medically a number of instances in 2022 can be viewed as turning points, especially for the major North American equity indexes.

When markets changed directions last year the frequent causes were economic announcements or the anticipation of these announcements on inflation, employment, economic output, monetary policy, recession, and geopolitical issues. Each of these factors, and many others, play into investor sentiment for the future, and influence or drive broad market moves.

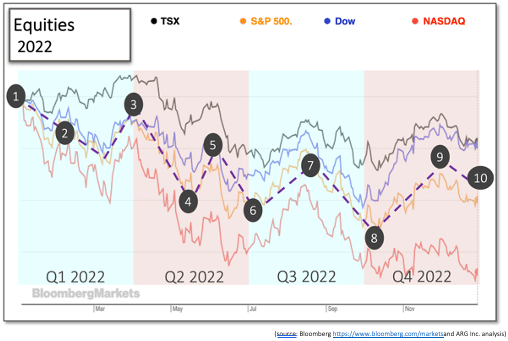

In addition to the beginning and end points of 2022 (#’s 1 and 10, below), the equity markets reversed their direction 8 significant times (#’s 2 through 9). The observed changes can be attributed to the linkages between inflation, interest rates, jobs, and economic output in the U.S.

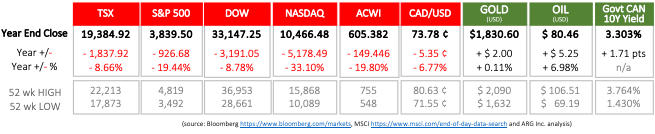

- The S&P 500, Dow, and NASDAQ, peaked on the first trading day of the year, January 4th, and dropped by 19, 9% and 33%, respectively, by the end of the year. The TSX, helped by its concentration on commodities, delayed its peak until late March and early April and still fell by nearly 9% in 2022. https://www.bloomberg.com/markets

- Russia invaded Ukraine on February 24th, providing foundation for the economic and humanitarian tragedy felt throughout the year. January 1st was the 312th day of war. The Guardian’s daily war summary

- The primary inflation indicator for the U.S. Federal Reserve, the Personal Consumption Expenditures (PCE) price index for February was released at the end of March. Consumer prices were rising at an annual rate of 6.4%, a level not seen in more than 40 years. https://tradingeconomics.com/united-states/pce-price-index

- April’s Consumer Price Index (CPI) edged downward providing lift to equity markets as year-over-year inflation rate fell to 8.3% from 8.5% in March. Prices rose 0.3% in April. BLS CPI

- The anticipation for the Fed’s interest rate announcement on June 15th was negative, and when May’s rising inflation, 8.6% year-over-year, was announced the markets began pricing-in a large increase to the federal funds rate, which eventually was 75 basis-points. BLS May inflation Federal Reserve announcement

- The release of U.S. employment data provided some respite from the fears of recession as the American economy continued to generate jobs at a robust pace. 372,000 jobs were created in June 2022 and the unemployment rate remained unchanged at 3.6%. BLS employment situation

- The minutes of the Federal Reserve’s Federal Open Market Committee were released. The meeting notes indicated that members of the committee believe that interest rates must be much higher than originally projected to reduce inflation to acceptable levels. FOMC Minutes from June meeting

- Again, consumer inflation exceeded expectations and remains well above the Fed’s target of 2%, suggesting that rates will be increased substantially again, potentially triggering a recession. The CPI for September, released on October 13th, sat at 8.2% on a year-over-year basis. Prices rose 0.4% in September compared with an increase of 0.1% in August. BLS September inflation

- The Federal Reserve’s FOMC raises benchmark interest rates again by 50 basis-points. Federal Reserve press release

- After two consecutive years of annual gains during a pandemic the major indices lost value in 2022. This is merely context for each investor’s individual portfolio performance. If your investment strategy delivers positive alpha, which is a return that exceeds the overall market, most investors would consider it a successful year. However, 2022 continued the pattern of 2020 and 2021 of increased levels of uncertainty, volatility, and risk.

Many other factors beyond “alpha” should be included in a robust analysis of portfolio performance, and simply measuring top-line performance in a “let’s earn as much as possible” mindset can lead to disappointment. Focusing solely on top-line performance reduces emphasis on volatility and ignores a goals-based approach to managing risk versus reward.

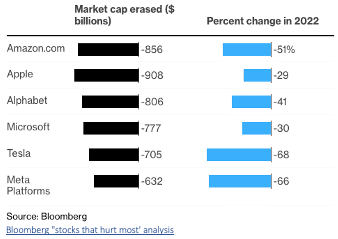

An example supporting a managed approach that includes diversification is the performance of a select number of stocks that had previously enjoyed excellent returns. In 2022, the S&P 500 lost over $9 Trillion in total value. It was only six stocks that contributed half of the loss, $4.7 Trillion, as of December 28th. If an investor had placed all their holdings evenly across these six stocks at the start of their year and did not adjust, they would have lost 48% of their balance. The entire S&P 500 index lost 19%. The “alpha” for this highly concentrated portfolio is negative 29%.

For most investors this information regarding very narrow holdings provides little solace but could be a catalyst for action to re-examine asset mix (equities vs fixed income), growth vs value stocks, industry, sector, and geographical diversification, for both individual stocks and funds.

What’s ahead for January and beyond in 2023?

In the near, medium, and longer-term the effects of central bank monetary policy on inflation, employment and prospects of further action will guide equity markets. The terminology that everyone will become more acquainted with in 2023 will include “restrictive monetary policy”, “filtering through”, “soft landing” and “recession”.

The purpose of increasing interest rates is to slow demand for goods and services because financed purchases have become more expensive than regular purchases. Businesses and consumers reduce their overall consumption due to higher prices, and reduced demand removes upward price pressures. If the reduction of consumption is substantial and prolonged a recession occurs.

The predictions from both the Bank of Canada and the U.S. Federal Reserve are that interest rate increases will slow, if not cease. Once inflation responds to monetary policy action, it is anticipated that those monetary measures (interest rates and quantitative tightening) will be maintained until further adjustments become necessary.

Once the trajectory of interest rates is better understood, the nature of markets will be clearer. A review of each investor’s unique situation and goals to anticipate this uncertainty is the starting point for a renewed investment plan.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.