Last Month in the Markets – February 1st – 28th, 2022

What happened in February?

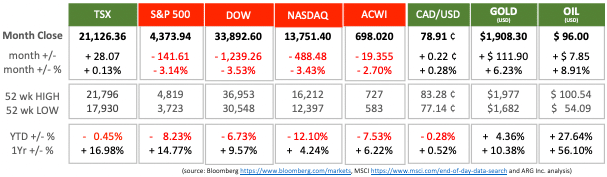

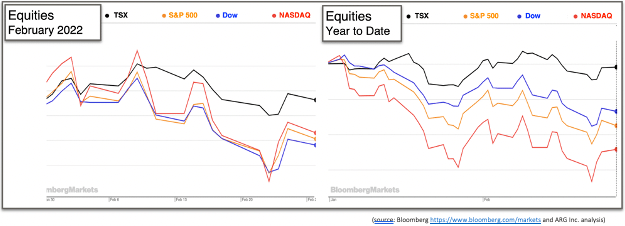

Prior to the invasion of Ukraine, North American equity markets had been doing relatively well despite less than favourable local news. The trend had been downward with the major indices losing value during the first three weeks of the month mirroring overall performance in 2022. Year-to-Date results range from a loss of ½% for the TSX to 12% for the NASDAQ. In Year-over-Year returns the NASDAQ has increased its value by 4% while the TSX has grown 17%. The S&P 500 and Dow sit between the TSX and NASDAQ on both measures.

This performance for the month was achieved amid mixed economic news and growing tension between the West and Russia over the massing of troops near the borders of Ukraine that eventually became an invasion. The U.S. added 467,000 jobs in January and was just 1.7 million jobs below pre-pandemic levels. Labour Force Participation (the number of employed people plus those seeking employment) is preventing the economy from fully recovering jobs. BLS source

The Canadian economy was not as resilient in January when 200,000 jobs were lost as the hospitality and food service sectors suffered most severely from Omicron. Thankfully, employment levels are still above pre-pandemic levels and should continue to grow once current restrictions are lifted. StatsCan source

Year-over-year U.S. consumer inflation exceeded most analysts’ predictions and grew by 0.6% in January to 7.5%. Prices rose 0.5% in December. Inflation sits at its highest level in forty years. Core inflation, which excludes the volatile consumer categories, food and energy, grew to 6.0%. Inflation had been testing the Federal Reserve’s already strained patience. https://www.bls.gov/news.release/cpi.nr0.htm

By comparison Canada’s inflation rate has risen to 5.1% year-over-year, the highest rate in 30 years. The continuation of heightened inflation here and in the U.S. extends the pressure on the Bank of Canada to raise interest rates as early as their next meeting on March 2nd.

The effects of Russia’s invasion of Ukraine at the end of the month has impacted almost every country and their capital markets. Although the global economy is interconnected, Russia’s level of interaction with most other countries and countries with large economies is relatively small. Its isolation from the West on political grounds persists economically. Russian economy is ranked 11th in size among countries at $1.483 Trillion in 2020, which is slightly larger than Brazil and Australia and only about 90% of Canada’s Gross Domestic Product (GDP).

Despite its small size Europe is dependent on Russia for oil and natural gas, receiving about 40% and 25%, respectively, of these two energy types. Also, Russia and Ukraine together account for nearly one-third of global wheat exports. Ukraine exports

A full-scale invasion by one nation into a separate sovereign country may have been doubted, many of the results have been measured and predictable:

- Governing bodies, like the United Nations, have condemned Russia’s breach of international law

- Russia’s relations with the global community, except for countries in its inner circle, are being severed diplomatically

- Trade embargos are limiting international sales of Russian products and services

- Russia is being cut-off from the global payments network, SWIFT, preventing the flow of capital

- Travel restrictions have been imposed on Russian airlines and citizens

- 500,000 refugees have fled westward from Ukraine, and the U.N. is preparing for 5 million in total

- Assets of the Russian Federation and its citizens held in foreign banks are being seized

- The price of commodities is climbing

- Oil breached $100 per barrel after rising more than 11% since February 25th

- Aluminum hit a record high and silver prices have jumped 10%

- 60 million barrels of strategic oil reserves will be released to contain the rapid increase in the price of oil Strategic Oil Reserves

- Traditional “safe haven” investments have also increased in value and volume

- Gold has increased $100 per ounce in the last month

- The U.S. dollar has strengthened against the Euro, Pound, Canadian dollar and many other currencies

- A rush to bonds has lowered yields in exchange for safety

- The Moscow stock market closed for its second consecutive day on March 1st to prevent a sell-off

- Russian firms, like Gazprom, that trade internationally have lost 20-50% of their value and several exchanges have halted trading in Russia-based firms

- The Russian Ruble has lost about 40% of its value against the U.S. dollar as of mid-morning on March 1st

A reversal of one, many or all changes, above, could occur rapidly should Russia abandon its ambitions in Ukraine, or some other breakthroughs occur. Unfortunately, these economic sanctions have not altered the course of the conflict on the ground. World Bank GDP Data Companies Exiting Russia Bloomberg on Safe Havens and Bonds

What’s ahead for March and beyond?

Two major influences that will dominate markets for the foreseeable future are the geopolitical situation in Ukraine and central bank monetary policy.

The damage caused to the global economy by Russia is just beginning to be felt. Embargos and restrictions are being instituted for Russian flights that limit them, effectively, to Russian airspace, goods and services are not travelling across international borders, sports teams are being disqualified from European and global events, like the World Cup. Financial assets for Russia and Russians are being seized.

Denying and preventing the free flow of goods, services, labour and capital to-and-from Russia will lower economic output for Russia and any countries that cannot replace the restricted economic activity. If sanctions deliver the intended results the losses will be felt almost exclusively in Russia.

The shortening of supply, especially for oil, is predicted to lead to increased inflation and subsequently to larger moves to contain price increases by central banks like the Bank of Canada, Federal Reserve, European Central Bank (ECB) and Bank of England. The by-product of inflation-fighting interest rate increases is typically and tempering of Gross Domestic Product growth and lowering of equity prices.

The Bank of Canada announces monetary policy updates on March 2nd, the ECB meets on March 10th and the Federal Reserve releases its latest interest rate guidance on March 16th.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.