Last Month in the Markets – November 1st – 30th,2021

What Happened in November?

November did not deliver the results that equity investors had hoped. There were three main contributors to the damage equity markets saw this month:

1) actual and rumored action by the Federal Reserve

2) commodities suffered from a predicted weakening of demand and

3) a new coronavirus variant has investors, health officials and governments concerned and taking restrictive actions.

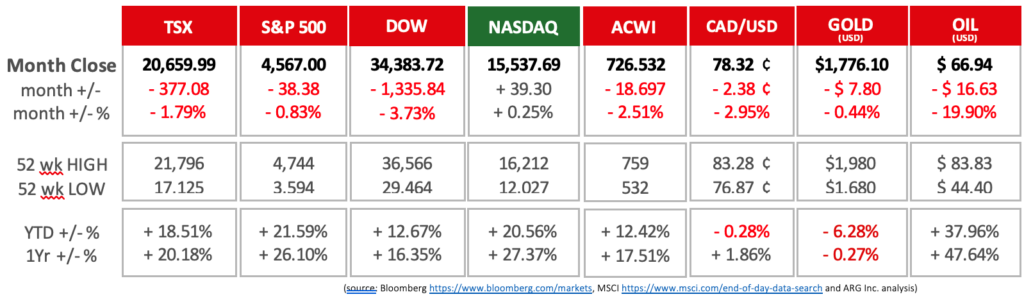

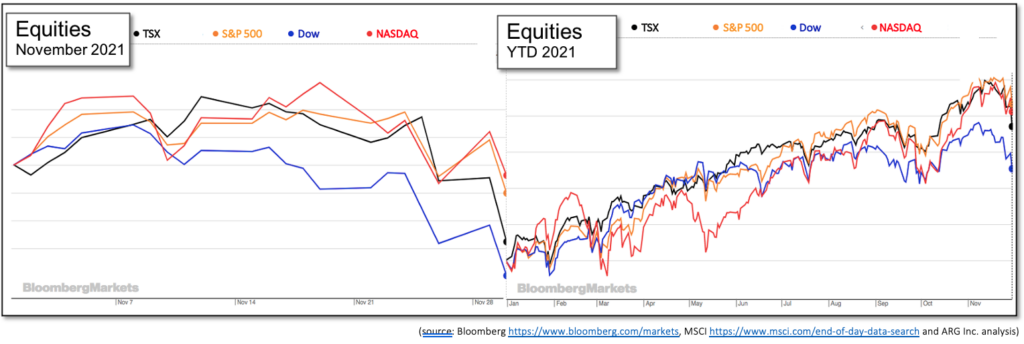

While the NASDAQ did see modest gains, the TSX, Dow and S&P 500 fell because of these negative influences occurring during the second half of the month. Indices peaked November 16th and 19th, which led to a dramatic decline during the last trading days of the month. Despite a disappointing month, indices are still performing well this year. Year-to-Date increases of 19%, 13%, 21%, and 22% for the TSX, Dow, NASDAQ, and S&P 500, respectively.

Jobs and Inflation

The first Wednesday of the month saw the U.S. Federal Reserve (the Fed), followed by the Bank of Canada’s (BoC), reduce their bond-buying program. Just the week before, the BoC eliminated the same program that supports lower-long-term borrowing costs in Canada. The Fed will reduce its purchases from $120 Billion/month to $15 Billion. This indicates that the Fed plans to end its buying after 8 months (June of 2022). These big moves by both central banks are strategic changes in attempt to curtail inflation. Inflation is much higher than the target rate and the temporary nature of price increases is being questioned. Fed Chair, Jerome Powell, indicated that short term interest rates would remain unchanged. A video of Powell’s announcement is available.

- Canada added 31,000 jobs last month and the unemployment rate fell to 6.7%. The prior month saw nearly five times as many jobs, which may indicate a softening of employment results.

- In October, the U.S. economy underperformed in job creation (194,000. They have since rebounded, adding 531,000 jobs in October, and lowering the unemployment rate further to 4.6%.

- The American wage rate has increased by 4.9% compared to the same period last year. Rising U.S. wages, along with more persistent housing costs and food prices, may have contributed to the Fed’s decision to slow its bond purchasing program to temper inflation.

- Equities in the U.S. have been negatively affected by the recent release of consumer and producer inflation numbers. The Consumer Price Index (CPI) has risen to 6.2% in October and the Producer Price Index (PPI) is at 8.6%. The CPI last reached this level in the U.S. in 1990.

- The Canadian inflation rate for October was 4.7%, up from 4.4% in September. From 2010 to 2019, inflation in Canada and the U.S. had averaged 1.6%, staying within the Bank of Canada’s target range of 1 to 3%.

- The inflation rates on both sides of the border are driving increased speculation that the Bank of Canada and the Federal Reserve will act to increase their benchmark lending rates to cool inflation and, subsequently, economic growth. Both central banks have set the average inflation target at 2%. At nearly 5%, and more than 6%, Canada and the U.S are well beyond the goal. Early analysis suggested that increased inflation rates were merely temporary as reopening expanded, but price increases are persisting, and it appears that it may be spring of 2022 before prices become more stable. This is evidence that interest rates will rise sooner than expected from a few months ago.

Covid Update

- The latest variant of concern, Omicron, which has been spreading rapidly in southern Africa, has driven global action. Travel restrictions have been reintroduced in several developed nations preventing foreign citizens entry when arriving from eight African countries.

- Economic recovery could see damage amid new fears of domestic restrictions and lockdowns. Such restrictions could curtail the movement of both people and materials. North American equity indices already have suffered losses on November 26th and again on November 30th , both can be attributed to the uncertainty surrounding the Omicron variant.

Oil and Gold

- Over the past month, the price of West Texas Intermediate (WTI) oil fell by more than $16/barrel, which is nearly 20% below its price at the end of October.

- Compared to equities and oil, gold held steady by dropping at only $7.80 per ounce (less than ½%), which demonstrated its potential as a safer haven than other asset classes.

What is Ahead for December and Beyond?

The uncertainty surrounding the latest variant, Omicron, and inflation remain a significant concern. The persistence, the breadth, and the size of price increases are pushing central banks across the globe to act sooner than originally believed.

The next monetary policy announcements by the Bank of Canada will take place December 8th and December 15th for U.S. Federal Reserve. The actions presented on these days will reflect the predicted effects of Omicron, inflation driven by rising wages, pent-up savings, and on-going supply chain issues.

If you have questions about financial planning in Calgary and wealth management in Calgary or would like to explore your options, connect with us to speak with a financial advisor in Calgary and get the answers you need to achieve your goals.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.