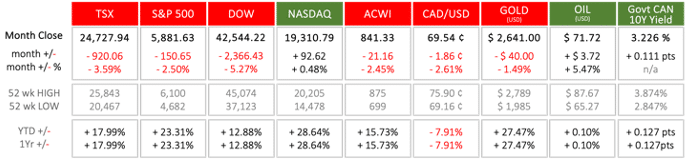

Last Month in the Markets: December 2nd – 31st, 2024

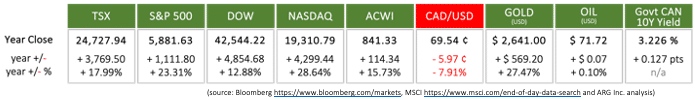

Last Year in the Markets: January 2nd -December 31st, 2024

What happened in 2024?

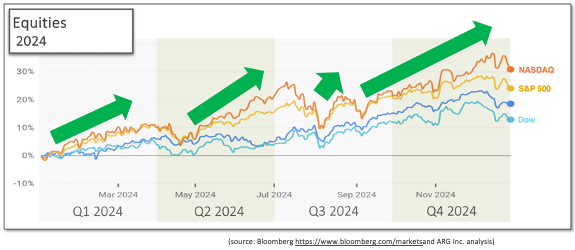

Last year was productive for equity investors, with Canadian and American indexes delivering remarkable returns for the second consecutive year. The TSX beat its 2023 performance by 10 percentage points, the S&P 500 fell just 1 percent behind last year’s stellar results, as did the Dow, and the NASDAQ more than doubled its 2023 performance in 2024.

The first quarter of 2024 was a steady climb after the first week, a short stumble in April was quickly recovered and a 3-month rise saw a 1-month decline from mid-July until early August. Between a short dip in September and the end of December saw equity values rise steadily and deliver strong results.

Canadian investors who spend time and money in the U.S. did not enjoy the 8 percent loss in value by the Canadian dollar. Thankfully oil prices ended the year where they began, and energy prices contributed to the overall moderating of inflation increases.

As inflation fell and job creation slowed action was taken by central banks to reduce interest rates to spur economic activity. Tracking inflation, employment and Gross Domestic Product to predict interest rate moves was the theme for analysts and investors in 2024.

Summary of economic events that contributed to market performance in 2024:

January 5th

U.S. nonfarm payroll employment increased 216,000 in December, exceeding analyst expectations. Strong jobs creation, typically, is good-news for equities in the short-term, but may not allow interest rates to fall further propelling the economy and equity values. BLS release CNBC Financial Post and jobs CNBC and jobs and rates

January 11th

The U.S. Bureau of Labor Statistics (BLS) released the Consumer Price Index for December, and year-over-year inflation for calendar 2024. Consumer prices rose 0.3% in December, up from 0.1% in November. Over the past 12 months, the all-items index increased 3.4%. BLS CPI release

January 18th

After a short period of tempering related to U.S. employment and inflation data, the S&P 500 set a new all-time closing high, and the Dow bested its previous record. U.S. equities were also assisted by a legislative advance, when the U.S. Congress approved another stop-gap spending bill to keep the federal government operating. These would be the first of many new records set by equity indexes in 2024. WaPo and spending bill

January 19th

The Canadian Consumer Price Index (CPI) rose 3.4% on a year-over-year basis in December 2023, after the same reading sat at 3.1% in November. For the month the CPI fell 0.3% in December, after a 0.1% gain in November. CPI Annual Review StatsCan and CPI CBC and CPI CityNews

January 24th

The Bank of Canada held its policy interest rate, the overnight rate, steady at 5%. “The Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.” BoC release and MPR

January 25th

Based on Gross Domestic Product, the American economy grew faster than expected and inflation cooled, according to the Bureau of Economic Analysis. In the fourth quarter GDP increased at a 3.3% annualized rate, and the rate of economic growth for the entire year of 2023 was 2.5%.

The Personal Consumption and Expenditure (PCE) price index, which is the Federal Reserve’s primary inflation measurement, rose 0.2% in December and 2.9% for 2023. Including food and energy headline inflation rose 2.6% annually at the end of December. The annualized rate of inflation is approaching the Fed’s low-term average goal of 2%. BEA GDP release CNBC and GDP BEA PCE release CNBC and PCE

January 31st

In one of their shortest written statements, the Fed communicated “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.” The statement suggested that the Federal Reserve’s interest rate committee, the FOMC, believes that the U.S. economy is performing well enough that it did not need monetary policy stimulus at that time, and monetary policy stimulus would add to a higher than desired rate of inflation. Fed release and presser

February 2nd

Canadian Gross Domestic Product (GDP) grew by 0.2% in November after three months of static performance. The slight expansion in growth was welcomed by investors because modest growth supported the easing of monetary policy. StatsCan release StatsCan and GDP

The U.S. economy’s ability to add jobs proved to be remarkably resilient. Total nonfarm payroll employment rose by 353,000 in January, the largest monthly increase since January 2023. Lower job creation would support the Federal Reserve lowering interest rates, but on its own merits, the robust employment situation is positive for the economy. BLS release CNBC and jobs

February 9th

The S&P 500 breached and closed over 5,000 points for the first time in its history. After closing over 4,000 points in April 2021, it took almost three years to reach the next millennium. Much of the U.S. gains were attributed to the growing sentiment that the Federal Reserve achieved a soft landing by slowing inflation, and not placing the economy into a recession.

January’s Labour Force Survey from StatsCan showed that employment increased by 37,000 after three months of little change. The unemployment rate fell 0.1% to 5.7%, it was the first decline in more than one year. StatsCan release CBC and LFS

February 13th

U.S. inflation was more persistent than expected. Continuing inflation above goal lessened the likelihood of a Federal Reserve rate cut. Year-over-year inflation remained above goal at 3.1%. On a monthly basis, prices rose 0.3% in January, higher than the 0.2% seen in December. BLS CPI release CNBC CPI and rates

February 16th

The Producer Price Index, that tracks the prices domestic producers receive for their output from customers who are not end-consumers. It provides a measure of insight into future consumer price levels as producer prices move through the supply chain toward end-buyers. The PPI rose 0.3% in January after declining 0.1% in December. The increase was small, but a price increase does not support falling interest rates. BLS PPI release CNBC and PPI

February 21st

The Federal Reserve released the minutes of its latest interest rate meeting that showed concern that progress against inflation could stall. The areas of concern were consumer spending and business hiring. The minutes included, “participants judged that the policy rate was likely at its peak for this tightening cycle.” The timing of interest rate reductions remained uncertain despite the progress against inflation. FOMC Minutes CNBC and FOMC Minutes

February 22nd

The NASDAQ jumped 3%, largely driven Nvidia, the computer chip manufacturer at the forefront of the artificial intelligence industry. Nvidia released an optimistic forecast of earnings that projected a threefold increase in quarterly revenue. Its fourth quarter revenue was $22.1 Billion, a 265% increase from Q4 2022. Nvidia’s share price jumped 11% on the day, and its value breached $2 Trillion and pulled the NASDAQ along with it. CNBC and Nvidia

The Canadian Consumer Price Index rose 2.9% on a year-over-year basis, down from 3.4% in December. Excluding gasoline, consumer prices rose 3.2% last month. Mortgage interest costs were the largest driver of inflation increasing at an annual rate of 27.4%. CPI release CBC and inflation

February 29th

The U.S. Personal Consumption Expenditures price index rose 2.4% in January, and core PCE (excluding food and energy) rose 2.8% on a year-over-year basis, and 0.4% in January. These levels were aligned with analyst expectations. PCE and CNBC BEA’s PCE

March 6th

The Bank of Canada held its policy interest rate unchanged. “The Bank continues to expect inflation to remain close to 3% during the first half of this year before gradually easing”. Tiff Macklem, Bank of Canada Governor stated, “We don’t want inflation to get stuck, materially, above our target.” BoC release CBC and BoC

March 7th

The European Central Bank (ECB) mirrored the Bank of Canada’s decision to keep policy interest rates unchanged. ECB staff project “inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026.” ECB release

March 8th

The U.S. economy added 275,000jobs, above the average monthly gain of 230,000 over that last year. The unemployment rate rose 0.2% to 3.9% as 334,000 more job seekers were unsuccessful and total 6.5 million, up 500,000 over February 2023. BLS release CNBC and jobs

March 12th

The Bureau of Labor Statistics reported that the U.S. Consumer Price Index rose 0.4% in February, up from January’s 0.3% rise. On a year-over-year basis consumer prices increased 3.2%. Shelter and gasoline contributed more than 60% of February’s one-month price inflation. BLS CPI release

March 19th

The Canadian Consumer Price Index rose 2.8% on a year-over-year basis in February, down from 2.9% in January. The slowing of inflation was positive news for consumers and borrowers. StatsCan release CBC and BoC

March 20th

The Federal Reserve kept its rates unchanged. The Fed released its quarterly Summary of Economic Projections (SEP) that indicated interest rates are expected to be lowered in 2024, 2025 and 2026. Fed release, SEP, and press conf

January’s Labour Force Survey (LFS) from StatsCan showed that employment increased by 37,000 following three months with little change in total jobs. The unemployment rate fell 0.1% to 5.7%, the first decline in more than one year. StatsCan release CBC and LFS

April 5th

Canadian and American job announcements demonstrated two differing economic directions. The strength or weakness of employment will contribute to upcoming interest rate announcements in each country.

Canadian employment fell by 2,000 jobs in March and the unemployment rate rose 0.3% to 6.1%. Since last year the Canadian unemployment rate has risen 1 percent as the number of unsuccessful job seekers has grown by approximately 60,000 over the past twelve months. StatsCan Labour Force Survey

In the U.S. total nonfarm payroll employment rose by 303,000 in March. It was the 39th consecutive month of rising employment. The unemployment rate sat at 3.8% and changed little since last month as 6.4 million workers attempted to find jobs. BLS Nonfarm Payroll Report

April 10th

The Bank of Canada held its policy interest rates unchanged. Canada was ahead of the U.S. in lowering domestic inflation, cooling the economy and employment, and “economists have forecast that the Bank of Canada will lead the U.S. Federal Reserve in rate cuts as economic data in both countries have been diverging.” BoC CBC

U.S. consumer prices increased 0.4% in March, the same increase that was reported one month ago for February. Over the past 12 months, the all-items index increased 3.5% in March, higher than the 3.2% recorded for February. BLS CPI release

April 16th

The Canadian federal budget proposed a change to the tax treatment of capital gains, which may facilitate portfolio adjustments for a small number of investors. Capital gains inside registered accounts (like TFSAs and RRSPs) and principal residences will not be affected. Outside of these accounts, gains below $250,000 will follow the current 50% inclusion rule, and above $250,000 two-thirds of the gain will be subject to taxation. 2024 Budget Chapter 8 CBC and Cap Gains

Canadian Consumer Price Index for March rose 0.1% from February and sits at 2.9% on a year-over-year basis. The rise in prices for shelter (rent and mortgage costs) and services was higher than goods, and in aggregate prices rose 0.6% in March. StatsCan CPI

April 25th

The latest real Gross Domestic Product data from the Bureau of Economic Analysis (BEA) showed that annualized economic growth has slowed to 1.6% in Q1 2024, down from 3.4% and 4.9% in Q4 and Q3 of 2023, respectively. Slowing GDP growth relieved pressure to maintain current interest rates. BEA release CNBC and GDP

April 26th

The Personal Consumption Expenditures price index fulfilled predictions. Jerome Powell, Fed Chair, stated that U.S. consumer inflation is reluctant to return to pre-pandemic levels despite the elevated levels of interest rates. Inflation arose due to a shortage of supply, which drove prices higher. As supply chain issues resolved and inflation persisted, central banks increased interest rates designed to curtail demand, and inflation, back to low and predictable levels. For March, U.S. PCE inflation was 2.7% year-over-year, compared with January and February’s 2.5%. All three months are above the Fed’s goal of an average of 2%. BEA PCE release CNBC and PCE

April 30th into May 1st

April transitioned into May with a Federal Reserve interest rate announcement. Markets awaited confirmation that the Federal Reserve would keep interest rates unchanged, and the Fed did not disappoint analysts. The federal funds rate will stay in the range of 5¼ to 5½ percent. Fed release Fed Press Conf CNBC and Fed rates

May 3rd

The non-farm payroll report from the U.S. Bureau of Labor Statistics showed that employment had increased by 175,000 in April, which was below expectations. Dow Jones consensus predicted 240,000 jobs. The unemployment rate ticked up 0.1% since March to reach 3.9%. After the jobs report, markets priced-in a strong chance of two interest rate cuts by the Federal Reserve before the end of 2024. BLS release CNBC and Non-Farm Payrolls

May 10th

The latest Canadian Labour Force Survey revealed that 90,000 jobs were created in April following little change in employment levels in March. Economists had predicted just 20,000 additional jobs. StatsCan LFS CBC and LFS

May 15th

In April, the U.S. Consumer Price Index ticked downward to 3.4% on a year-over-year basis. The inflation news provided positive energy to major indexes following the announcement the S&P 500 jumped 1.2%, the Dow rose 1.4% and the NASDAQ moved 0.9% higher. The S&P 500 and NASDAQ each touched new record highs, with all three indexes achieving new record closing levels. BLS release CNBC stocks CPI and rate cuts

May 21st

StatsCan reported, “The Consumer Price Index rose 2.7% on a year-over-year basis in April, down from a 2.9% gain in March.” The overall effect on Bank of Canada rate decisions was uncertain. The encouraging trajectory of inflation in Canada was tempered by path of U.S. inflation, where the cooling not been as successful. StatsCan CPI release CBC, CPI and BoC

May 24th

The S&P 500 earnings season neared its completion as 96% of companies having reported results, and 78% delivered a positive earnings surprise, and 61% achieved a positive revenue surprise. FactSet Insights Q1 2024.

May 31st

The major Canadian news was the release of Gross Domestic Product, which increased 0.4% for the first quarter of 2024 after achieving no change in the final quarter of 2023. On a year-over-year basis GDP grew 1.7% during the quarter. CBC and GDP

The U.S. Personal Consumption Expenditures price index rose 0.2% in April and was unchanged on a year-over-year basis compared to March at 2.7% and remained above the 2.5% level seen in both January and February. BEA PCE release CNBC and PCE

June 2nd

U.S. jobs market continued its strong growth when nonfarm payroll increased by 339,000 in May, which was more than March and April’s employment increases of 217,000 and 294,000, respectively. The average monthly gain in employment over the past 12 months had been 341,000, showing that jobs growth has returned to more robust levels.

June 6th

The Organization for Economic Cooperation and Development (OECD) reported April consumer inflation at 7.4% for its 38 member countries. Inflation had been 7.7% in March as 27 countries reported a decline, but inflation exceeded 10% in 10 countries and surpassed 20% in Hungary and Turkey. Also, the OECD projects global growth at 2.7% this year, 2.9% in 2024, which is below the 3.4% average growth seen in the seven years prior to the pandemic.

June 9th

Canadian “overall employment was little changed in May, as employment fell by 77,000 for youth aged 15 to 24 and it increased by 63,000 among people aged 25 to 64” according to StatsCan. Despite the small gain in total employment, growth moderated and suggested that this economic indicator is heading toward neutral or negative territory.

June 13th

The Bureau of Labor Statistics released U.S. inflation data for May that showed consumer price increases of 0.1% in May and year-over-year of 4.0%. Prices had risen 0.4% in April, and May’s annualized inflation rate was the lowest since March 2021.

June 14th

The Federal Reserve held rates steady, and markets reacted mostly favourably. The pause in interest rate changes is expected to be temporary since the 2% inflation target had not been reached. Fed’s Summary of Economic Projections, which contains the dot-plot, which collects the individual opinions of Federal Open Market Committee (FOMC) members for upcoming interest rates, was also released. Currently, FOMC members projected that interest rates will rise into 2024 before falling slightly, and lower rates in the 3 to 3½% range will arrive in 2025.

June 21st

Jerome Powell during his testimony to the House Financial Services Committee stated, “the process of getting inflation down to 2% has a long way to go.” Powell’s support for additional rate increases markets tempering its enthusiasm for the Fed’s pause earlier in the month.

June 30th

The U.S. Bureau of Economic Analysis reported the Personal Consumption and Expenditures price index rose by 0.1% in May after rising 0.4% in April.

July 5th

The Federal Reserve released meeting minutes from its previous Federal Open Market Committee that included interest rate deliberations and opinions of its committee members. The belief that the federal funds rate must be raised to 5.6% (up from their March 2023 projection of 5.1%), and their unanimous decision to raise rates at their mid-June meeting, sent equity markets lower. FOMC Meeting Minutes Summary of Econ Projections

July 7th

Continued strength in employment for June held markets steady. The increase of 60,000 and 209,000 additional jobs in Canada and the U.S., respectively, represented a situation where “good news” might actually be “bad news”. A robust labour market that is able to fuel consumer demand and inflation might require more severe monetary policy from the Bank of Canada and the Federal Reserve. Markets were wary and held their ground on this news that might otherwise be interpreted positively. StatsCan June Jobs BLS U.S. June Jobs

July 12th

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index had risen 0.2% in June, and the all-items index rose 3.0% over the last 12 months. Shelter continued as the largest contributor to price increases. BLS and CPI

The Bank of Canada increased its benchmark interest rate by ¼ percent (25 basis points to 5%. The small increase was aligned with expectations and was driven by easing inflation and lower energy prices and a decline in goods price inflation. “However, robust demand and tight labour markets are causing persistent inflationary pressures in services” according to the Bank’s press release and in its Monetary Policy Report.

The lowering inflation and tempered policy by the Bank of Canada were viewed positively and Canadian equity values, generally, turned upward in response.

June 18th

Good news was announced by StatsCan as consumer inflation rose on a year-over-year basis by 2.8%, which was down from the previous month’s annual inflation of 3.4%. StatsCan CPI Release

July 26th

The Federal Reserve increased its interest rates by 25 basis points (¼ percent). There had been some hope that a pause in rate increases might be permitted by slowing inflation, but once the news was received it was digested well, and markets rose again. Fed Press Conf

July 28th

The Consumption Expenditures price index showed an increase of 3.0% over the past year and 0.2% for June, which was more positive news. PCE Release

August 1st

Fitch Ratings downgraded the quality of U.S. sovereign debt from “AAA” to “AA+” reflecting “the expected fiscal deterioration over the next three years, a high and growing general government (GG) debt burden, and the erosion of governance relative to . . . peers . . . that has manifested in repeated debt limit standoffs and last-minute resolutions.” The government debt issue is driven by weaker federal government revenue, new spending initiatives and higher interest rates as the general government deficit is predicted to rise to 6.9% of Gross Domestic Product in 2025 as the GG debt-to-GDP ratio is forecasted to rise to 118.4% by 2025. CBC and Fitch Press Release from Fitch

August 4th

American and Canadian jobs reports were released. Markets treated this data with wariness since the U.S. job market continued its resiliency, while Canadian jobs became scarcer. The U.S. non-farm payroll employment rose by 187,000 jobs in July, and the unemployment rate was unchanged at 3.5% suggesting U.S. interest rates would not change. Employment in Canada was static in July with 6,000 less jobs, which represents a change of less than one-tenth of one percent. The unemployment rate rose 0.1% to 5.5%, the third consecutive monthly increase. StatsCan July Jobs BLS July Jobs NYTimes Jobs

August 16th

Economic indicators from China, the world’s second largest economy with significant international trade, began to turn downward. China’s economic recovery and growth are slowing. The economic integration by Canada and the U.S. differs in magnitude and by overall trade balance, and “bad news from China” has affected different stocks and sectors differently in North America. Canada’s closer ties caused a steeper decline than American indexes, but overall, both sides of the border have been impacted. China Trading Partners China’s economic woes

August 31st

Atlanta Federal Reserve Bank President Raphael Bostic indicated that “policy is appropriately restrictive” during a speech in Cape Town, South Africa. Although he did not indicate that it was time to ease monetary policy, he stated patience is needed to allow the current restrictive policy to influence the economy and not inflict unnecessary economic pain.” The Fed was expected to raise rates at its next meeting. CNBC and Bostic

September 1st

The U.S. employment report showed 187,000 nonfarm payroll jobs were added in August, and the unemployment rate rose to 3.8%. BLS release

September 6th

The Bank of Canada held its target for the overnight rate at 5%. Considerations included the moderating of inflation in advanced economies, while remaining above goal, slowing global growth, led by China, and robust consumer spending in the U.S. Bank of Canada announcement

September 13th

U.S. consumer prices rose 0.6% in August, after rising only 0.2% in July. “Over the last 12 months, the all-items index increased 3.7 percent before seasonal adjustment” according to the Bureau of Labor Statistics. Core inflation, which excludes food and energy, rose more than expected at 0.3% for the month. CNBC and August inflation BLS release CNN and August inflation

September 18th

Federal Reserve, Chair Powell stated, “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed, and the unemployment rate has moved up, but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.” Consequently, the federal funds rate was lowered ½ percentage points. Federal Reserve announcement and press conference

September 29th

Based on the Personal Consumption and Expenditures price index prices in August rose by 0.4%, down from 0.9% in June. It was the smallest monthly increase since November. Core PCE was 3.9%, which matched the forecasts. The continuing improvements in the battle against inflation suggests that the Federal Reserve is nearing the end of its rate increases. BEA’s PCE release CNBC and PCE

September 30th

The trading-week had ended before a deal was reached in the House of Representatives on Saturday evening. It was a stop-gap measure that extended spending for an additional 45 days. CNBC and “shutdown” CNN and “shutdown”

October 4th

The U.S. Bureau of Labor Statistics reported that September’s nonfarm payroll grew by254,000 jobs, which was higher than August’s 159,000. The unemployment rate in September was essentially unchanged at 4.1% compared with 4.2% in August. CNBC and nonfarm payrolls

October 9th

The Federal Reserve released the meeting minutes from their last Federal Open Market Committee (FOMC) interest rate decision on September 18th. Committee members were divided between ¼ and ½ reduction, with the larger cut ultimately carrying the vote, 11-1. Recent jobs data suggests that a more gradual approach may have been appropriate. FOMC minutes CNBC and FOMC

October 10th

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index rose 0.2 percent for the month in September. On a year-over-year basis prices rose 2.4 percent, down slightly from August’s annualized reading of 2.5 percent. BLS CPI release CNBC and CPI

October 11th

According to StatsCan’s Labour Force Survey for September, employment rose by 47,000 and the unemployment rate fell 0.1 percentage points to 6.5%. It was the largest monthly increase in two years. The consensus remained that the condition of the economy would continue to encourage Bank of Canada rate cuts. StatsCan release CBC and jobs

October 15th

StatsCan announced the Consumer Price Index rose 1.6% on a year-over-year basis in September, down from 2.0% in August. It was the smallest yearly increase since February 2021. The inflation rate, like employment, encouraged the Bank of Canada to reduce its policy interest rate. StatsCan CPI release CBC and CPI

October 23rd

The Bank of Canada cut its policy rate another ½ percent (50 basis points). After three ¼ point cuts and this ½ point cut, the overnight rate has been lowered to 3.75 percent from its peak of 5 percent. The rate cuts have contributed to the lowering of year-over-year inflation, which sits at 1.6% according to the recent StatsCan release.

The Bank of Canada also released its quarterly Monetary Policy Report, which outlined its rationale behind its rate cut and expectations for the economy, employment and inflation. BoC rate announcement Monetary Policy Report CBC and BoC rate cut

October 31st

The U.S. Personal Consumption Expenditures price index dropped 0.2 percent to 2.1 percent on a year-over-year basis in September compared with August. BEA PCE release CNBC and PCE

November 1st

U.S. employment (+12,000) and unemployment at 4.1 percent were unchanged in October according to the nonfarm payroll report. The low jobs increase, and election uncertainty created a dip for equities to start November. BLS Nonfarm Payrolls release

November 5th to 8th

A decisive election win was the best result for equity investors. A Republican-controlled Senate and House will facilitate the confirmation of federal appointees and the passing of laws. President-elect Trump has promised an extension to his 2017 corporate tax reductions, increased government spending and decreased regulation, which encourage positive corporate results and increased values. NBC News and markets Global and election results CNBC on elections and markets

November 6th

The Federal Reserve lowered its policy interest rate by ¼ percent (25 basis points). The release included “In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/2 to 4-3/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.” Fed release

November 8th

StatsCan’s Labour Force Survey for October reported that employment (+15,000) and unemployment (6.5%) remained static. Despite the lack of jobs growth in October, employment was up 303,000 on a year-over-year basis. StatsCan release

November 13th

Markets settled downward after the large gains of the previous week that had been driven by certainty of U.S. election victories. Once the election results were decided, markets refocused on corporate performance and overall economic conditions to drive markets. CNBC election and valuation

Before markets opened, the U.S. Consumer Price Index for October was reported. For the fourth consecutive month CPI increased 0.2 percent on a monthly basis. On a year-over-year basis consumer prices have increased 2.6 percent. BLS CPI release

The inflation results suggested that the Fed may slow the pace and size of rate cuts as inflation moved upward. Tariff promises made by President-elect Trump would raise inflation, which would also delay rate cuts further into the future.CNBC and CPI (2)

November 19th

The Canadian Consumer Price Index rose 2.0% on a year-over-year basis in October, up from the 1.6% increase in September. This is the first increase in the rate of inflation since May. Although the rate of inflation has increased, it is at the goal rate set by the Bank of Canada. Over the past three years, prices for goods rose 10.2%, while prices for services increased 14.2%. StatsCan CPI release CBC and CPI

November 22nd

Strong corporate results spurred equities along as earnings season drew to a close. After 95 percent of the S&P 500 had reported their Q3 results, three-quarters of the companies reported a positive Earnings Per Share (EPS) surprise, and nearly two-thirds reported a positive revenue surprise. FactSet Earnings Insight

November 27th

Prices rose 0.2% in October and 2.3% on a year-over-year basis according to the Personal Consumption Expenditures price index. The annualized inflation rate met expectations. BEA PCE release CNBC and PCE

November 29th

Canada’s economic growth stalled. After remaining unchanged in August, Gross Domestic Product (GDP) edged up 0.1% in September. Real GDP increased 0.3% in the third quarter, after rising 0.5% in both the first and second quarters of 2024. On a per capita basis, GDP fell 0.4% in the third quarter, which was the sixth consecutive quarterly decline. On an annualized basis, the Canadian economy grew 1% in the third quarter, down from 2.2% in the second quarter. StatsCan Sept GDP StatsCan Q3 GDP CTV and GDP

December 6th

Canadian employment increased by 51,000 in November following little change in October, according to the Labour Force Survey. The unemployment rate rose 0.3% to 6.8% indicating an increase in job seekers. The unemployment rate has risen 2 percentage points since July 2022. CBC and LFS

The U.S. nonfarm payroll report showed employment rose 227,000 in November and the unemployment rate was unchanged at 4.2%. Job creation was above expectations and October’s flat report. Since last November the number of unemployed persons has risen by nearly 1 million to 7.1 million from 6.3 million when the unemployment rate was 3.7 percent, which was a historically low level. BLS release CNBC and payrolls

December 11th

The U.S. Consumer Price Index increased 0.3 percent in November, after four consecutive monthly rises of 0.2 percent. The “all items index” rose 2.7 over the last 12 months before seasonal adjustment. BLS CPI release

The Bank of Canada reduced its policy interest rate by ½ percent (50 basis points) to 3¼ percent. This is the fifth consecutive rate reduction since June. Canadian inflation has been around the Bank’s 2% target. The possibility that the incoming U.S. administration will impose new tariffs on Canadian exports to the U.S. has increased uncertainty and clouded the economic outlook. Nonetheless, current economic performance warranted the rate reduction as explained in the press conference after the release. CBC and Boc rates

December 16th

Canadian news centred on political and inflation news. Monday brought the federal government’s Fall Economic Statement. The deficit has risen to $61.9 Billion, far above the most recent projection of $40 Billion. Chrystia Freeland resigned as Finance Minister and calls for an election and the resignation of Prime Minister Trudeau intensified. FES and CBC FES and CBC (2)

In November the Canadian Consumer Price Index rose 1.9% on a year-over-year basis, down from 2.0% in October. Slower price growth was broad-based with the deceleration caused by prices for travel tours and mortgage interest costs. However, grocery prices have risen nearly 20% over the past two years. During the month of November prices rose 0.4%, the same increase as October. StatsCan CPI release

December 18th

Major economic news came from the U.S. Federal Reserve on Wednesday, and the effect was negative. American equity indexes fell between 3 and 4 percent following the Fed’s interest rate announcement. At the end of Wednesday the Dow had fallen for the tenth consecutive day, losing more than 6 percent over the period before generating a small gain on Thursday. A rally for equity indexes on Friday limited the losses for the week to about half of Wednesday’s drop.

After concluding that “Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor [sic] market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated” the target for the federal funds rate was lowered by ¼ percent to a range of 4¼ to 4½ percent.

Lower interest rates typically spur economic expansion and push equity values higher. However, the Fed indicated that it would likely lower interest rates only twice in 2025 according to its Summary of Economic Projections, not four times, as it had previously indicated in September. The slowing of interest rate reductions carried negative sentiment through to the end of the year for equity indexes. Fed announcement CNBC and rates.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of the persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities. Contact your financial advisor in Calgary or your Financial Planner in Calgary to discuss your personal situation.