Calgary Investment Management

An investment strategy with tailored support that helps you make smart decisions about your wealth and takes you from where you are to where you want to be.

Results

Commitment

We can help you preserve and grow your investments in any market condition with our proven financial system and exclusive strategies.

Innovative Investment Management Services

Traditional wealth management models no longer provide you with clear-cut investments that maximize your money. At MRG Investments of Aligned Capital Partners, our specialized investment philosophy is a new-age model that gives you more robust financial opportunities, helps maximize your capital and secures your future.

Our financial advisors will help you make smart decisions about your wealth and take you from where you are to where you want to get to. Experience investment management that works for you.

Investment Philosophy

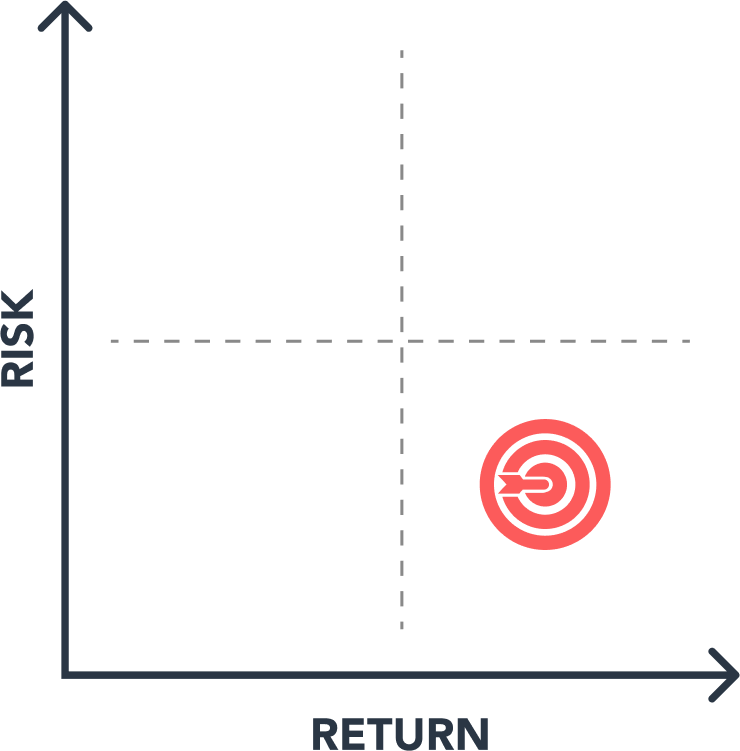

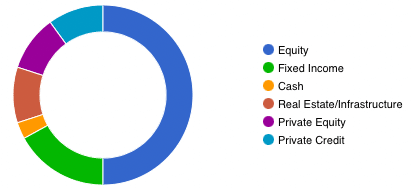

- Risk of a client not achieving their financial goals, and thus not being able to live the life they want.

- A client’s investment risk tolerance and risk capacity, which are used to determine the appropriate global asset allocation for their investment portfolio.

Many Canadians don’t have access to different types of investments. We developed a system to provide access to all of our clients.

An Investment Manager

You Can Trust

Trust and value form the foundation for our relationships. Our wealth team will build you a personalized wealth strategy that targets your financial goals while addressing any challenges. Our financial advisors will openly communicate and explain your plan, including the opportunities presented, giving you confidence when making decisions.

Investment Management

Catered To Your Financial Goals

Profitability

Profitability

Value

Value

Financial Strength

Financial Strength

Diversification

Diversification

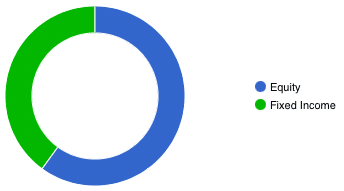

Market correction resulting in you losing your wealth.

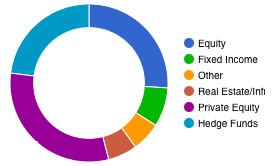

By investing in only 2 asset classes you are exposed to the risk that if anything happens to 1 of them, you could have a major impact on your financial future.

Not getting the returns and growth you need to achieve your goals and live the life you want.

Not experiencing the growth and cash flow you need can impact your ability to achieve your goals.

Note: Mutual funds and exchange traded funds (ETFs) are mainly a wrapper for these 2 types of asset classes.

2 Assets Classes

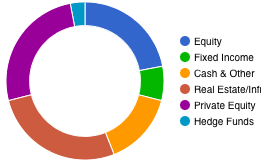

Canada Pension Plan (CPP)

CPP Annual Report

Yale

Yale Financial Statements

High Net-Worth Individuals

Tiger 21 Members

Return

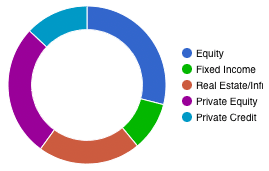

Investing in multiple asset classes could help you realize the investment return you require to achieve your goals.

Risk

Investing in non-market correlated asset classes could help you reduce your risk, preserve your capital, and grow your wealth even when the equity and bond markets decline.

Multiple Asset Classes

How we are paid

Investment Management

- first million: 1.50%

- second million: 1.00%

- over $2 million: 0.50%

client minimum: $500,000.

Are you confident in your

financial future?

Protection from market

corrections

Investments growing at a rate required to achieve your goals

Trusted and unbiased professional advice and support

Tax-optimized financial

planning

Client Success Process

Select each step to learn more

Introduction

(1st Meeting)

Discovery

(2nd Meeting)

Wealth Strategy

(3rd Meeting)

Review & Update

(4th+ Meeting)

Introduction

(1st Meeting)

Discovery

(2nd Meeting)

Get Started – Become A Client

- Review and sign new client paperwork to become a client using our simple digital process.

- Your investment accounts will be transferred from your previous financial institution over to your new accounts at National Bank.*

- As your investments are being transferred, which usually takes a month, we start the financial planning process.

*Investment services provided by MRG Investments of Aligned Capital Partners Inc.

Wealth Strategy

(3rd Meeting)

- Financial Management

- Investments

- Retirement

- Risk Management & Insurance

- Tax Optimization

- Estate

Review & Update

(4th+ Meeting)

A key to success is continually monitoring and adjusting your wealth strategy based on life, economic, and political changes. Through regular communication and updates, we help you stay on track to achieve your goals regardless of what curve balls life may throw your way.

Financial System: a collection of plans with continual updates

Financial Plan: 1 and done, outdated as soon as printed

Frequently Asked Questions

It is a simplified, integrated, and effective wealth management system that integrates the six critical components of your financial life, enabling you to experience synergies and value that helps you experience more in life. It consists of Financial Management, Tax Optimization, Risk Management & Insurance, Retirement Planning, Investments, and Estate Planning.

Aligned Capital Partners Inc. (ACPI) is a full-service investment dealer and a member of the Canadian Investment Protection Fund (CIPF) and the Canadian Investment Regulatory Organization (CIRO). Investment services are provided by MRG Investments, an approved trade name of ACPI.

For your security and convenience, your investments are held at CI Investment Services, providing custody, trade execution and brokerage solutions to independent Portfolio Managers and Investment Dealers.

Aligned Capital Partners Inc. (ACPI) is a member of the Canadian Investor Protection Fund (CIPF). Only investment related products and services are offered by ACPI/MRG Investments and covered by the CIPF. Financial planning and insurance services are provided by MRG Wealth Management. MRG Wealth Management is an independent company separate and distinct from ACPI/MRG Investments. All non-securities related business conducted by MRG Wealth Management is not covered by the Canadian Investor Protection Fund (CIPF).