Calgary Financial Planners

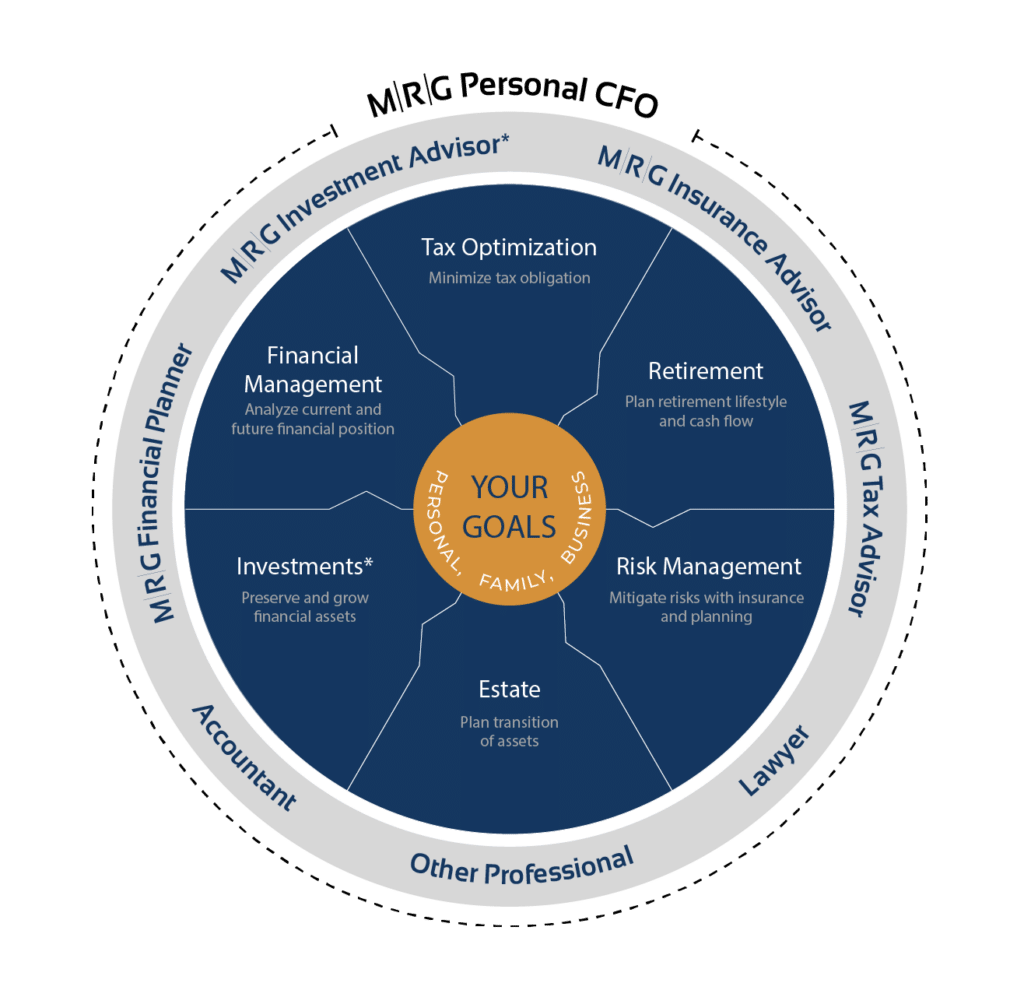

Our tax-optimized financial planning process helps you simplify and integrate your financial life, obtain clarity and confidence in your financial decisions, and empowers you to experience more in life.

Life-Changing Financial Planners

It’s time your needs are met. At MRG Wealth Management, our financial planners understand that to plan a successful and comfortable future, your financial situation and needs must be understood. It’s what we’ll do.

Our Calgary financial advisors will listen to your goals and build an integrated and personalized financial system that delivers on them. If your lifestyle evolves, we’ll update your plan so you still live the life you want while providing life-changing wealth management services.

Integrated Financial Management

Our wealth management system and financial planners help you simplify and integrate your financial life, obtain clarity and confidence in your financial decisions, and empowers you to experience more in life.

Optimization

Management

Financial Planners with an Unique Approach

We know that the traditional approach to investing and financial planning no longer works. Our unique financial planning approach is built on a proven financial system that integrates your six critical financial areas, enabling you to experience synergies and value that you haven’t experienced before. Most importantly, it helps you achieve your goals in an efficient and effective process. Your financial planning experience with us will include your values and goals, potential challenges, risks and vulnerabilities, a thorough review of your investment portfolio, opportunities, and a detailed roadmap to success. Experience a new, unique way with us.

Professional Financing Planning & Advice

Proven Financial

System

Proven Financial

System

Exclusive Financial

Strategies

Exclusive Financial

Strategies

Certified Financial

Planners

Certified Financial

Planners

Specialized Tax

Knowledge

Specialized Tax

Knowledge

Personalized

Relationships &

Support

Personalized

Relationships &

Support

How are you managing the 5 big challenges that can

jeopardize your financial future?

Our financial planners have the expertise and solutions to get you from where you are to where you want to be.

Market Correction

resulting in you losing money

Limited Growth

resulting in you not achieving your goals

Taxes

resulting in you having less of your hard earned wealth

Unmanaged risk

resulting in major impacts to your financial future

Lack of Planning

resulting in costly mistakes

Client Success Process

Select each step to learn more

Introduction

(1st Meeting)

Discovery

(2nd Meeting)

Wealth Strategy

(3rd Meeting)

Review & Update

(4th+ Meeting)

Introduction

(1st Meeting)

Discovery

(2nd Meeting)

Get Started – Become A Client

- Review and sign new client paperwork to become a client using our simple digital process.

- Your investment accounts will be transferred from your previous financial institution over to your new accounts at National Bank.*

- As your investments are being transferred, which usually takes a month, we start the financial planning process.

*Investment services provided by MRG Investments of Aligned Capital Partners Inc.

Wealth Strategy

(3rd Meeting)

- Financial Management

- Investments

- Retirement

- Risk Management & Insurance

- Tax Optimization

- Estate

Review & Update

(4th+ Meeting)

A key to success is continually monitoring and adjusting your wealth strategy based on life, economic, and political changes. Through regular communication and updates, we help you stay on track to achieve your goals regardless of what curve balls life may throw your way.

Financial System: a collection of plans with continual updates

Financial Plan: 1 and done, outdated as soon as printed

Our Financial Planners Simplify Wealth Management

You want the best financial planners for your future. With our team, you have them. From retirement planning to estate planning and everything in between, we can help all individuals in different professions and industries, small and large business owners and retirees looking to enjoy their life. We understand the complex economic variables and how it relates to your situation. You’ll feel comfortable and confident with your financial decisions as we’ll make attaining your secure financial future simple.

Financial Planning

starting from

$2,500

Value & Goals

Vulnerabilities & Opportunities

Personal Balance Sheet

Personal Cash Flow

Investments

Savings

Retirement

CPP/OAS

Withdrawal

Risk Management & Insurance

Tax

Estate

Child Education

starting from

$3,500

Everything in Family +

Corporate Wealth Strategies

Legal Structure

Corporate Investments

Corporate Savings

Business Owner Compensation

Corporate Risk Management & Insurance

Health Spending Account

Group Benefits

Business Continuation (Buy/Sell)

Corporate Succession

Your Secure Financial Future

Finance

Goals

Challenges

Net Worth

Cash Flow

Tax

Personal Tax Strategies

Corporate Tax Strategies

Deductions and Credits

Retire

Savings

Withdrawal

CPP

OAS

Pension

Risk

Review of existing insurance

Life insurance

Disability Insurance

Critical Illness Insurance

Long Term Care

Travel Insurance

Kids Insurance

Health & Dental Insurance

Health Spending Account

Buy-Sell Insurance

Key Person Insurance

Group Benefits

Estate

Will/Power of Attorney/Personal Directives

Intergenerational Wealth Transfer

Charitable Giving

Trusts

Estate Tax Minimization

Invest

Risk Tolerance

Asset Allocation

Asset Location

Frequently Asked Questions

It is a simplified, integrated, and effective wealth management system that integrates the six critical components of your financial life, enabling you to experience synergies and value that helps you experience more in life. It consists of Financial Management, Tax Optimization, Risk Management & Insurance, Retirement Planning, Investments, and Estate Planning.

Knowledge and understanding

leads to increased success