Last Month in the Markets – July 3rd – 31st, 2023

What happened in July?

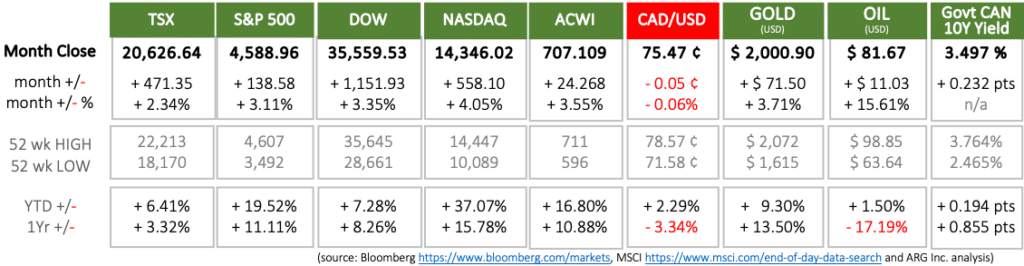

North American equity indexes added another 2 to 4 percent to their year-to-date advances on positive news on the inflation, jobs, and monetary policy fronts. Gold, oil, and Canadian government bonds also increased as the Canadian dollar nearly broke-even after losing just five one-hundredths of a cent by month’s end.

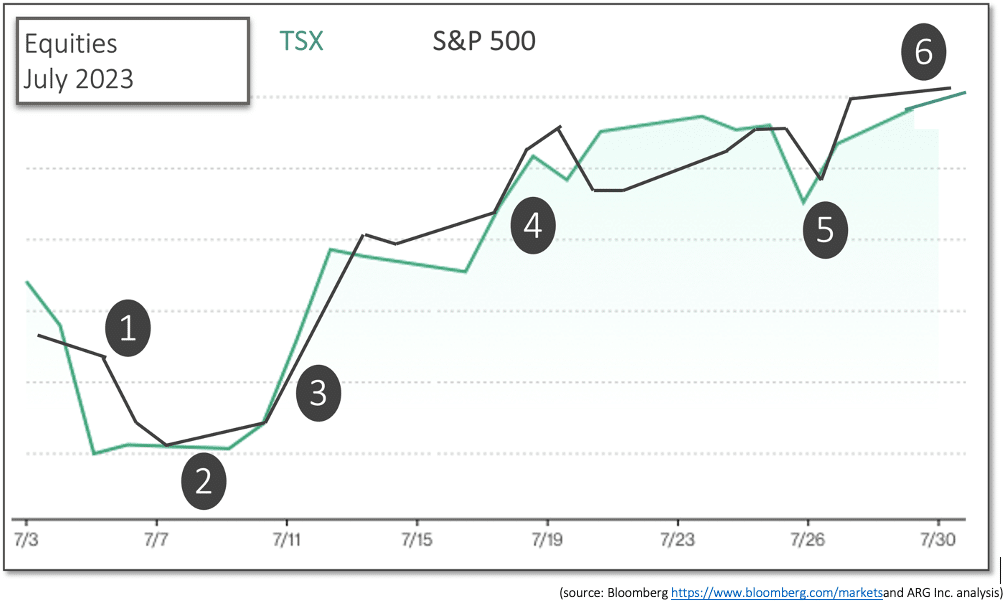

Like last month, July ended strongly. June achieved an exceptional day of gains for equity indexes on the 30th, while July earned its positive returns over the last two-thirds of the month.

- July 5th

The month began slowly with markets closed for the official observance on July 3rd of Canada Day and Independence Day on July 4th. Following the two holidays the Federal Reserve released the meeting minutes from its previous Federal Open Market Committee that included interest rate deliberations and opinions of its committee members. The belief that the federal funds rate must be raised to 5.6% (up from their March 2023 projection of 5.1%), and their unanimous decision to raise rates at their mid-June meeting, sent equity markets lower. FOMC Meeting Minutes Summary of Econ Projections

2. July 7th

Continued strength in employment for June held markets steady. The increase of 60,000 and 209,000 additional jobs in Canada and the U.S., respectively, represented a situation where “good news” might actually be “bad news”. A robust labour market that is able to fuel consumer demand and inflation might require more severe monetary policy from the Bank of Canada and the Federal Reserve. Markets were wary, and held their ground, and did not rise on this news that might otherwise be interpreted positively. StatsCan June Jobs BLS U.S. June Jobs

3. July 12th

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index had risen 0.2% in June, and the all-items index had risen 3.0% over the last 12 months. Shelter continued as the largest contributor to price increases, along with groceries and food away from home. Energy prices fell, especially gasoline, heating oil and natural gas, while electricity prices rose.

The Bank of Canada increased its benchmark interest rate by ¼ percent (25 basis points to 5%. The small increase was aligned with expectations and was driven by easing inflation and lower energy prices and a decline in goods price inflation. “However, robust demand and tight labour markets are causing persistent inflationary pressures in services” according to the Bank’s press release and in its Monetary Policy Report.

The lowering inflation and tempered policy by the Bank of Canada were viewed positively and markets turned upward in response.

4. June 18th

Actual good news was announced by StatsCan as consumer inflation rose on a year-over-year basis by 2.8%, which was down from the previous month’s annual inflation of 3.4%. The devil-is-in-the-details since much of the decline could be attributed to falling gasoline prices in June. “Excluding gasoline, headline inflation would have been 4.0% in June, following a 4.4% increase in May. Canadians continued to see elevated grocery prices (+9.1%) and mortgage interest costs (+30.1%)” based on StatsCan analysis. StatsCan CPI Release

5. July 26th

The Federal Reserve increased its interest rates, again by 25 basis points (¼ percent). There may have been some hope that a pause in rate increases might be permitted by slowing inflation, but once the news was received it was digested well, and markets rose again. Fed Press Conf

6. July 28th

The Fed’s primary inflation indicator, the Personal Consumption Expenditures price index showed an increase of 3.0% over the past year and 0.2% for June, which is a very positive indicator. PCE Release

What’s ahead for August and beyond in 2023?

The continuous flow of news of the battle against inflation and interest rates is wearying. Although, the conditions persist to ensure that monetary policy will be closely followed, the next Bank of Canada and Federal Reserve announcements will occur on September 7th and 20th, respectively. A brief reprieve from the bombardment of speculation and news from central banks could be quiet to markets and the balance of summer.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.