Last Month in the Markets – June 1st – 30th, 2023

What happened?

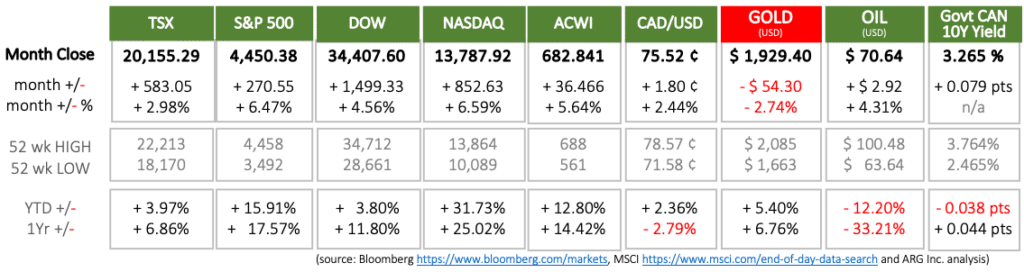

Equities rose at a substantially higher rate in June than the previous five months of the year. For example, the TSX is ahead 4% in 2023 with ¾’s of that gain occurring last month. The Dow rose 4½% last month and is now nearly 4% in-the-black for the year.

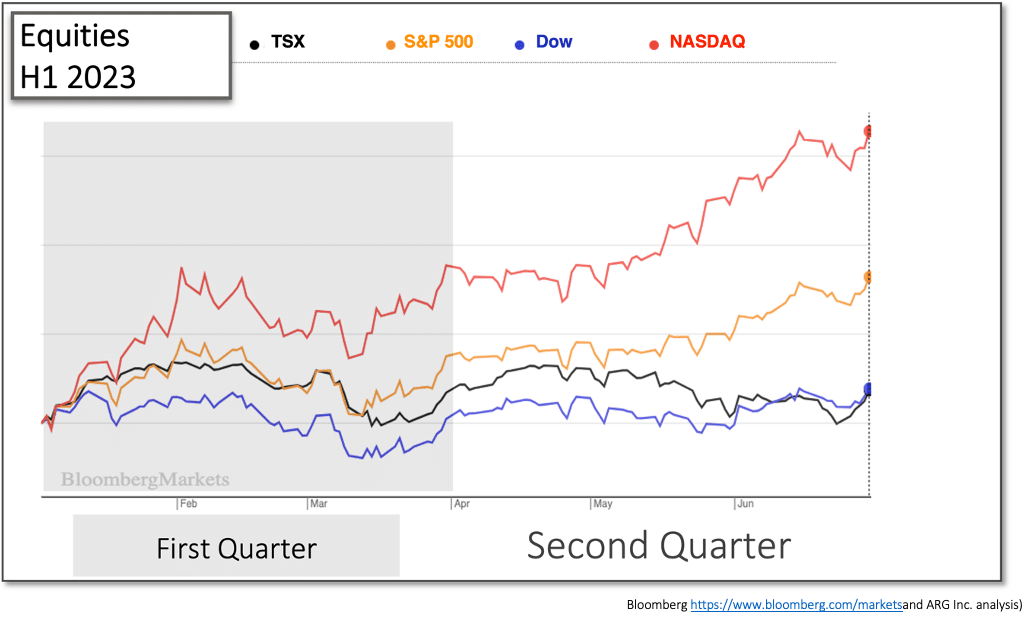

The first of half of the year saw equities performing well, especially during the second quarter and in June. The NASDAQ was the clear winner among North American indexes after posting a jump of nearly 32% this year. The S&P 500 managed to gain almost exactly half the NASDAQ’s increase by posting an increase of 15.9% over 6 months, which is also impressive. The 30 major corporate constituents of the Dow rose 3.8% collectively and were edged-out by the nearly 4% rise of the TSX.

The rise in equities can be attributed to the resiliency of two major economic indicators, economic growth, and employment, despite persistent inflation above target levels and almost uninterrupted interest rate increases by central banks.

What happened in June?

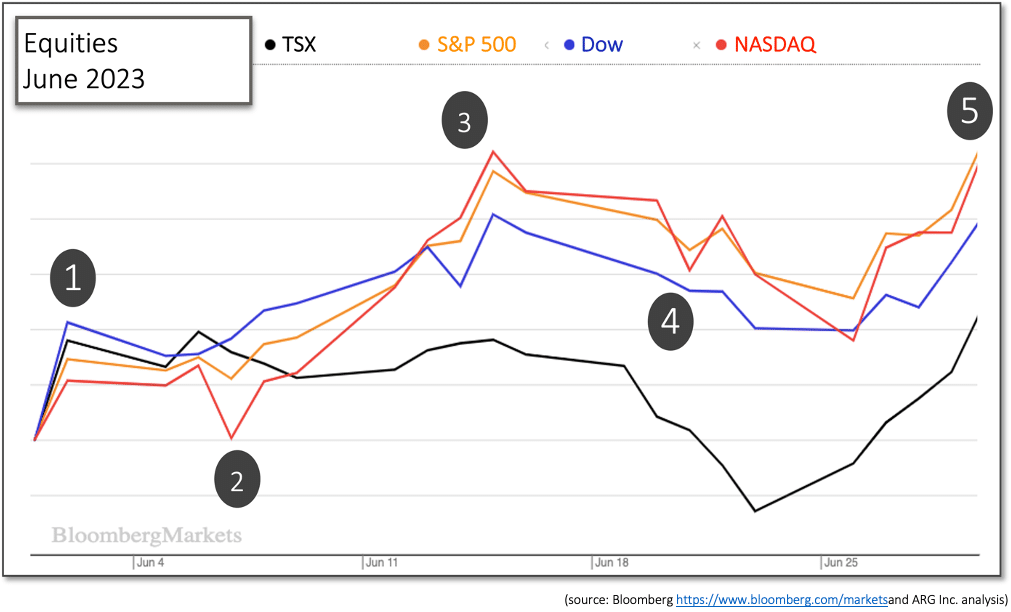

June ended very strongly with an exceptional day of gains for equity indexes on the 30th. Prior to the last day several significant economic events spurred markets forward, and not always upward. Typically, many of the influences affecting Canadian and American markets emanate from the U.S., and June was no exception.

1. June 2nd – The month began with good news as the U.S. jobs market continued its strong growth when nonfarm payroll increased by 339,000 in May, which is more than March and April’s employment increases of 217,000 and 294,000, respectively. The average monthly gain in employment over the past 12 months has been 341,000, showing that job growth has returned to more robust levels. Unemployment rose 0.3% to 3.7% despite gains in services, construction, healthcare, transportation, government, and warehousing.

2. June 6th – The Organization for Economic Cooperation and Development (OECD) reported April consumer inflation at 7.4% for its 38 member countries. Inflation had been 7.7% in March as 27 countries reported a decline, but inflation exceeded 10% in 10 countries and surpassed 20% in Hungary and Turkey. Also, the OECD projects global growth at 2.7% this year, 2.9% in 2024, which is below the 3.4% average growth seen in the seven years prior to the pandemic.

June 9th – Canadian “overall employment was little changed in May, as employment fell by 77,000 for youth aged 15 to 24 and it increased by 63,000 among people aged 25 to 64” according to the latest data from StatsCan. Despite the small gain in total employment, growth has moderated suggesting that this economic indicator is heading toward neutral or negative territory.

3. June 13th – The Bureau of Labor Statistics released U.S. inflation data for May showing consumer price increases of 0.1% in May and year-over-year of 4.0%. Prices had risen 0.4% in April, and May’s annualized inflation rate was the lowest since March 2021.

June 14th – The Federal Reserve made its latest interest rate decision, holding rates steady, and markets reacted mostly favourably. The pause in interest rate increases is expected to be temporary according to the information released with the announcement since the 2% inflation target has not been reached. Simultaneous to the interest rate announcement was the release of the Fed’s Summary of Economic Projections, which contains the dot-plot, which collects the individual opinions of Federal Open Market Committee (FOMC) members for upcoming interest rates. Currently, FOMC members project that interest rates will rise into 2024 before falling slightly, and lower rates in the 3 to 3½% range will arrive in 2025.

4. June 21st – Jerome Powell during his testimony to the House Financial Services Committee stated, “The process of getting inflation down to 2% has a long way to go.” Powell’s support for additional rate increaseshas markets tempering their enthusiasm for the Fed’s pause earlier in the month.

5. June 30th – The Bureau of Economic Analysis reported the Personal Consumption and Expenditures price index rose by 0.1% in May after rising 0.4% in April. The PCE is the Federal Reserve’s primary inflation indicator, and raising rates high enough to slow spending, but maintain modest growth is the goal. Markets signified that the Fed is closer to that target than believed just a few days earlier after Powell announced in Madrid that he expects slower rate increases.

On balance, each of these major influences, and many more, have delivered positive effects on equities, where most retirement investors are concentrated. Each of the announcements (above) has arrived with some negative elements but has almost universally caused a rise in values.

What’s ahead for July and beyond in 2023?

The battle against inflation will continue to be waged as the resiliency of the major and global economies continues. Demand has been strong and only recently shown signs of abating. The next interest rate decisions from the Bank of Canada, Federal Reserve and European Central Bank (July 12th, 26th and 27th, respectively) will account for past decisions and the relative strength of economies.

Subsequent interest rate decisions are not scheduled until mid-September, which will require a heavy reliance on each central bank’s projections for growth, employment, and inflation to carry through to the autumn.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.