Last Month in the Markets: May 1st – 31st, 2024

What happened in May?

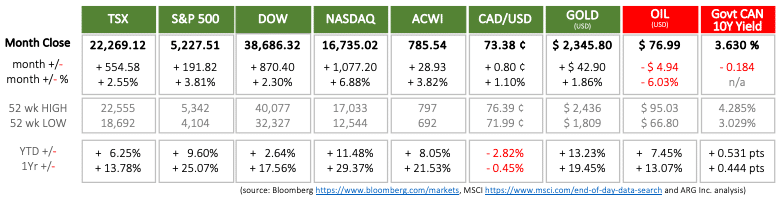

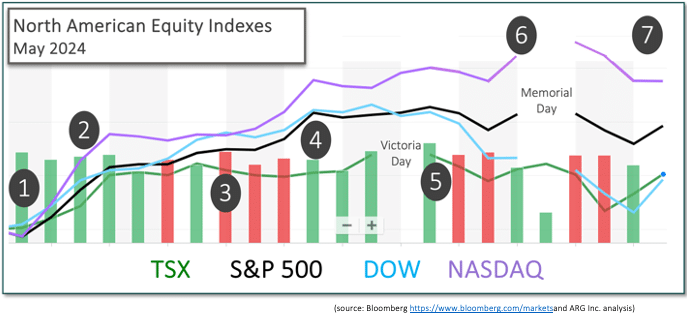

Equity indexes performed well during the first half of the month, before leveling-off and in some cases dropping before month’s end. The NASDAQ’s performance far outstripped the fine returns of the other indexes and compared to the S&P 500 and the global indicator, the All-Country World Index (ACWI) that each delivered nearly 4%. The TSX and Dow were the laggards, and still managed to deliver 2½%.

The Canadian dollar and gold performed well, while oil and Government of Canada bonds dipped.

Throughout the month several events and announcements triggered positive and negative reactions from equity indexes:

- May 1st

The U.S. Federal Reserve kept the federal funds rate’s target range unchanged at 5¼ percent. During the press conference immediately following the rate announcement, Fed Chair, Jerome Powell, stated, “Inflation is still too high. Further progress in bringing it down is not assured and the path forward is uncertain.” The Fed’s tradition of avoiding expectations of rate cuts continues. Fed Press Conf CNBC and Fed rates

2. May 3rd

The non-farm payroll report from the Bureau of Labor Statistics showed that employment had increased by 175,000 in April, which was below expectations. Dow Jones consensus predicted 240,000 jobs. The unemployment rate ticked up 0.1% since March to reach 3.9%. After the jobs report, markets priced-in a strong chance of two interest rate cuts by the Federal Reserve before the end of 2024. BLS release CNBC and Non-Farm Payrolls

3. May 10th

The latest Canadian Labour Force Survey released on Friday revealed that 90,000 jobs were created in April following little change in employment levels in March. Economists had predicted just 20,000 additional jobs. StatsCan LFS CBC and LFS

4. May 15th

In April, the Consumer Price Index (CPI) ticked downward to 3.4% on a year-over-year basis. By contrast, Canada’s most recent inflation reading, for March, stood at 2.9% on an annualized basis. The inflation news provided positive energy to major indexes following the announcement the S&P 500 jumped 1.2%, the Dow rose 1.4% and the NASDAQ moved 0.9% higher. The S&P 500 and NASDAQ each touched new record highs, with all three indexes achieving new record closing levels. BLS CPI release CNBC stocks CPI and rate cuts

5. May 21st

According to StatsCan, “The Consumer Price Index (CPI) rose 2.7% on a year-over-year basis in April, down from a 2.9% gain in March.” The overall effect on Bank of Canada rate decisions is uncertain. The encouraging trajectory of inflation in Canada is tempered by the path of U.S. inflation, where the cooling has been as successful. StatsCan CPI release CBC, CPI and BoC

6. May 24th

The S&P 500 earnings season is nearing its completion as 96% of companies have reported, and 78% have delivered a positive earnings surprise, and 61% achieving a positive revenue surprise. These results may have not been reflected in last week’s performance, but the S&P 500 is more than 11% in 2024 and nearly 29% in the past year. FactSet Insights Q1 2024.

7. May 31st

The major Canadian news was the release of Gross Domestic Product data on Friday. Real GDP increased 0.4% for the first quarter of 2024 after achieving no change in the final quarter of 2023. On a year-over-year basis GDP grew 1.7% during the quarter. CBC and GDP

The Personal Consumption Expenditures (PCE) price index is the preferred inflation indicator for the Federal Reserve. In April the PCE rose 0.2% and was unchanged on a year-over-year basis compared to March at 2.7% and remained above the 2.5% level seen in both January and February. BEA PCE release CNBC and PCE

What’s ahead for May and beyond?

Interest rates will continue to heavily influence markets as inflation continues to cool, economies slow and jobs growth decline. The Bank of Canada will release interest rate updates on June 5th, July 24th and September 4th. The Federal Reserve’s next scheduled opportunities to adjust interest rates are June 12th, July 31st and September 18th.

It is unlikely that the Fed will adjust rates downward until mid-September, but many are predicting a Bank of Canada rate cut in either June or July. Canada’s relatively better success against inflation and the recent GDP slowing promotes earlier action than in the U.S. CME FedWatch tool CBC and GDP

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.