Last Month in the Markets: October 1st – 31st, 2024

What happened in October?

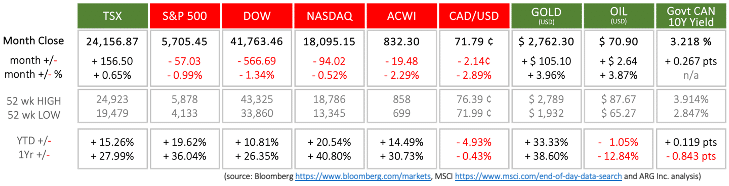

Record highs were set again for the TSX, S&P 500 and the Dow, and the NASDAQ almost achieved the same feat, falling less than 1% short of its highest level. Gold continued its winning-ways and rose to its highest price of all-time, ending the month 4% higher, and 33% more than its price at the beginning of 2024. Oil rose nearly 4% for the week but remains below its 2024 starting price and significantly below the level of one year ago. Bond yields rose more than 250 basis points.

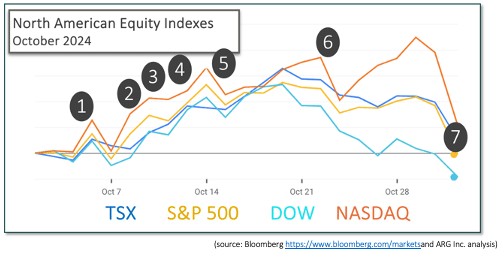

The notable events included:

- October 4th

The U.S. Bureau of Labor Statistics released September’s nonfarm payroll report showing that 254,000 jobs were added, much higher than the 159,000 in August. In September 6.3 million people were unemployed. The unemployment rate in September was essentially unchanged at 4.1% compared with 4.2% in August. CNBC and nonfarm payrolls

2. October 9th

The Federal Reserve released the meeting minutes from their last Federal Open Market Committee (FOMC)interest rate decision on September 18. Committee members were divided between ¼ and ½ reduction, with the larger cut ultimately carrying the vote, 11-1. Recent jobs data suggests that a more gradual approach may have been appropriate. FOMC minutes CNBC and FOMC

3. October 10th

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index rose 0.2 percent for the month in September. On a year-over-year basis prices have risen 2.4 percent, down slightly from August’s annualized reading of 2.5 percent. In September, the index for shelter rose 0.2 percent, and food increased 0.4 percent. Together these two indexes contributed over 75 percent of the monthly increase. BLS CPI release CNBC and CPI

4. October 11th

According to StatsCan’s Labour Force Survey for September, employment rose by 47,000 and the unemployment rate fell 0.1 percentage points to 6.5%. It was the largest monthly increase in two years. Gains were made by youth and core-aged women. The information, culture recreation (+22,000), wholesale and retail trade (+22,000) and professional, scientific and technical services (+21,000) sectors added the most employees. The consensus remains that the condition of the economy continues to encourage the Bank of Canada to continue cutting rates. StatsCan release CBC and jobs

5. October 15th

StatsCan announced the Consumer Price Index rose 1.6% on a year-over-year basis in September, down from 2.0% in August. It was the smallest yearly increase since February 2021. Gasoline fell by over than 10% in September and was the major contributor to inflation’s deceleration. The price of groceries rose 2.4% in September, the same growth rate as August. The lowering inflation rate encourages the Bank of Canada to continue reducing its policy interest rate. StatsCan CPI release CBC and CPI

6. October 23rd

The Bank of Canada cut its policy rate another ½ percent (50 basis points). After three ¼ point cuts and this ½ point cut, the overnight rate has been lowered to 3.75 percent from its peak of 5 percent. The rate cuts have contributed to the lowering of year-over-year inflation, which sits at 1.6% according to the recent StatsCan release.

The Bank of Canada also released its quarterly Monetary Policy Report outlining its rationale behind its rate cut and expectations for the economy, employment and inflation. BoC rate announcement Monetary Policy Report CBC and BoC rate cut

7. October 31st

The U.S. Personal Consumption Expenditures (PCE) price index dropped 0.2 percent to 2.1 percent on a year-over-year basis in September compared with August. Core PCE, which excludes food and energy, was 2.7 percent year-over-year, maintaining the same level for the past three months. BEA PCE release CNBC and PCE

What’s ahead for November and beyond?

November began with the release of October’s nonfarm payroll report. Employment was essentially unchanged (+12,000), and the unemployment rate remained at 4.1 percent. Dow Jones had predicted 100,000 jobs. The number of unemployed was little changed at 7.0 million. The two hurricanes in the Gulf of Mexico and the Boeing strike contributed to the slower than expected jobs growth. Employment increased in health care and government and declined in temporary help services and manufacturing.

Equity markets reacted positively to begin the month with all major North American indexes posting positive gains. Financial markets are predicting a rate cut of ¼ percent at the next two Federal Reserve announcements this year according to CME Group’s FedWatch tool. The next interest rate decision will be announced on November 6th. BLS release CNBC and jobs

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of the persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities. Contact your financial advisor in Calgary or your Financial Planner in Calgary to discuss your personal situation.