Last Month in the Markets – September 1st – 30th, 2022

(source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in September?

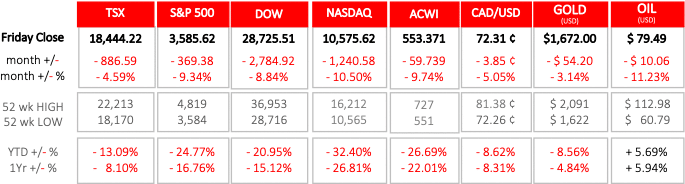

September is typically a bad month for North American equities with the S&P 500 typically losing 1% of their value. September 2022 was more than nine times worse, and the worst September in twenty years.

All three U.S. indexes in our grid are in bear market territory each having lost more than 20% of their value from the peaks. So far in 2022 the TSX has lost “only” about half the amount of the S&P 500. The tech-heavy NASDAQ has lost about one-third more than the S&P 500 and is down 32% in 2022. The Dow has lost more in 2022 (21%) than one year ago (15%) like its U.S. peers.

By examining the first three quarters of 2022 some interesting trends begin to emerge:

- Although the magnitude of the losses varies by index, the pattern of each mirror one another

- With the overall trend downward, there have been short periods of recovery

- The effects on Canadian and American equities in a balanced mix (S&P and TSX), or large corporates (Dow), or technology companies (NASDAQ) have occurred simultaneously

(source: Bloomberg https://www.bloomberg.com/markets and ARG Inc. analysis)

Inflation and the monetary policy response have been the primary drivers of market performance for most of this year. Equity indexes lost 11 to 13% during the third quarter with most of the losses being confirmed during the last 3 to 4 weeks. During this short period that concluded the quarter, several central banks, the Federal Reserve, European Central Bank, Bank of England, and Bank of Canada, have all made significant increases to their benchmark lending rates.

Although these rate increases were anticipated, and priced-in to markets there were some unexpected results and commentary. Inflation within most geographies remained stubbornly high. Employment and job creation continued at its strong and elevated rates. In this situation central bankers can attack inflation more aggressively, while allowing some pain in the job market.

The commentary from Fed Chair, Jerome Powell, on September 21st addressing their commitment to fighting inflation triggered the downward slide at the end of the quarter. The fear in markets that the Fed would continue to sacrifice jobs and economic growth to fight inflation by further raising interest rates was outlined in their Summary of Economic Projections. The federal funds rate has been predicted to increase again before the end of 2022 and continue to climb next year before beginning to fall in 2024 and beyond. Fed Press Release Equity Performance source

What’s ahead for October and beyond?

The battle against inflation will continue for the foreseeable future, and the associated negative effects on equities from higher interest rates will also continue. At some point equity values will reflect either the actual or anticipated results of increased interest rates, or the belief that central banks no longer need to increase or maintain high interest rates, because inflation has been tempered sufficiently.

Geopolitics has a role to play, too. The invasion and recent annexation of Ukraine territory by Russia will cause supply shocks and price increases on agricultural products and energy. Until the war is ended, either militarily or diplomatically through a negotiated détente, monetary policy will be forced to deliver more of the inflation-fight.

Managers at active funds are acutely aware of these forces and are adjusting their holdings within their mandates. Not each set of investment guidelines is equally suited to withstanding the current economic and market environment. Different countries, regions, industries, and sector offer unique challenges and opportunities. Asset Classes provide another level of diversification during difficult periods.

Unpredictable and volatile times often warrant an investment review to ensure the relative and absolute levels of risk associated with your owned assets are appropriate. More than two years of pandemic, recovery, inflation, conflict, supply chain issues and loss have transpired.

Many of these situations are unprecedented and the rest have laid dormant for a decade or more, and professional investment management will respond. According to BlackRock “inflation peaks and market rallies often go hand in hand”. Since 1927 equities have responded with an average increase of 11.5% in the year following peak inflation. As with all averages the components include elements that exceed and lag the cumulative performance, but it is important to position your portfolio to match your needs. BlackRock source

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.