Last Month in the Markets – May 1st – 31st, 2023

What happened in May?

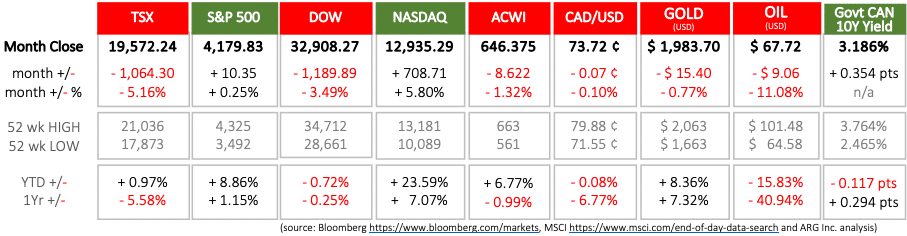

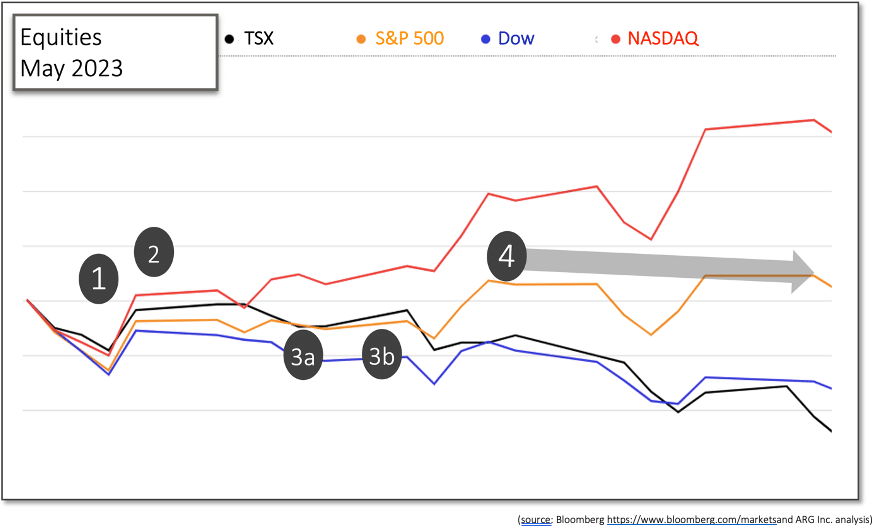

Last month saw divergence among major North American equity indexes with two increasing and two decreasing in value. The NASDAQ gained more than Canada’s TSX lost, plus 6% against minus 5%. The S&P 500 and the Dow delivered performance with a gap of nearly 4%, plus ¼% versus minus 3½%, respectively. The risk of a negative economic shock from the U.S. debt ceiling situation played against increasing optimism for technology stocks concentrated in the NASDAQ with the growth of Artificial Intelligence (A.I.).

May concluded with the passage of the debt ceiling bill in the U.S. House of Representatives that will keep the government operating and allow the U.S. Treasury to meet its obligations when it is passed by the Senate and signed into law by President Biden. Prior to the deal that was negotiated by President Biden and House Speaker McCarthy several other influential events occurred.

- May 3rd – U.S. Federal Reserve increased its federal funds rate by 25 basis points. Predictions that the Fed would not raise rates were proved wrong, but the meeting minutes of the Federal Open Market Committee indicated that the decision was not unanimous. Equities dipped temporarily on recession fears. https://www.federalreserve.gov/monetarypolicy/fomcpresconf20230503.htm

- May 5th – Equities recovered quickly from the Fed’s rate increase when Canadian and U.S. jobs data was released. Employment rose by 41,000 and 253,000 in April respectively, and unemployment remained unchanged in both countries at 5.0% and 3.4%. The strength of the jobs market showed that a recession was not immediately on the horizon. https://www150.statcan.gc.ca/n1/daily-quotidien/230505/dq230505a-eng.htm?HPA=1&indid=3587-2&indgeo=0 https://www.bls.gov/news.release/empsit.nr0.htm

- May 10th – Inflation has not responded to interest rate increases as much as needed, but has not grown much worse, and had markets holding steady. Inflation news was neutral, and it was not apparent if the U.S. central bank, the Federal Reserve, would stop interest rate rises.

- U.S. consumer inflation rose 0.4% in April and 4.9% on a year-over-year basis. Shelter was the largest contributor to the monthly increase, followed by vehicle and gasoline prices. https://www.bls.gov/news.release/cpi.nr0.htm

- May 16th – Canadian inflation rose more in April at 0.7% for the month and 4.4% for the year. https://www150.statcan.gc.ca/n1/daily-quotidien/230505/dq230505a-eng.htm?HPA=1&indid=3587-2&indgeo=0

- U.S. debt ceiling arguments and negotiations continued throughout the month and became increasingly concerning for markets during the second-half as the deadline to avert a crisis approached. Over the last weekend of May, a deal was agreed by Biden and McCarthy. Over the next three days of May the legislation, The Fiscal Responsibility Act, was debated and passed in the House. It is being fast-tracked through the Senate. The goal is to enact this new law before the deadline of June 5th set by Treasury Secretary Yellen when U.S. government debt obligations would go unmet. https://www.cnbc.com/2023/06/01/debt-ceiling-bill-updates.html

During the first half-day of trading since the House passed the debt bill equity indexes rose ½ to 1% indicating that an important hurdle had been cleared.

What’s ahead for June and beyond in 2023?

Now that the U.S. debt ceiling crisis seems to have been avoided, pending passage in the U.S. Senate markets will return to their usual priorities, inflation, interest rates, economic growth, and the linkages between them.

Inflation has stopped growing but is remaining much higher than the 2% annual rate targeted by Canadian and American central banks. Further interest rate increases aimed at lowering demand, particularly consumer demand and consumer spending, increase the threat of a recession. Traditionally a recession was defined as two or more quarters of negative economic growth. The updated definition of recession is “a significant, widespread and prolonged downturn in economic activity.”

The goal for Fed Chair, Jerome Powell, and Bank of Canada Governor, Tiff Macklem, is to raise rates just high enough to curb inflation and not induce a recession. The next two opportunities to adjust interest rates are June 7th in Canada and June 14th in the U.S. Whether the interest rate pause continues in Canada or begins in the U.S. will provide insight to path of the economy, and markets, in the near term.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.