Last Month in the Markets – November 1st – 30th, 2022

What happened in November?

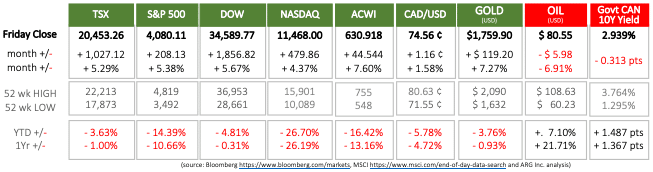

Overall, the results for investors were largely positive last month. The major Canadian and American equity indexes rose 4.4 to 5.7%, and the global All Country World Index (ACWI) jumped 7.6%. The Canadian dollar gained more than a cent as many snowbirds prepare for their annual winter migration for warmer weather in the United States. The price of oil fell, which will assist consumers (and snowbirds who will be driving 2,000 kilometres or more to reach their winter havens). Gold’s lustre as a safe-haven continued, and although bond yields were down slightly for the month, they have doubled in 2022.

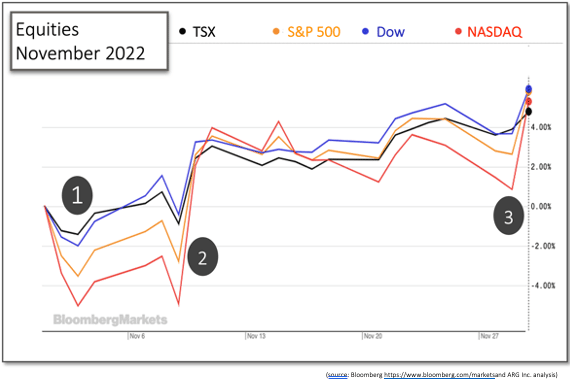

Three notable events were primary triggers for broad moves in North American equity markets last month. For November, and due to the tight linkage of the Canadian economy to the American economy, the major events that raised and lowered the TSX and the U.S. indexes were from south of our border.

- November 2nd – Federal Reserve interest rate decision

The question was not whether an increase would occur, but the size of it and the implications for future increases were the focus of speculation. Chair, Jerome Powell, announced a 75-basis point (¾%) interest rate increase to extend the monetary policy battle against inflation. Federal Reserve release CNBC article

- November 10th – U.S. Consumer Price Index released

U.S. consumer inflation generated a rebound from recent losses. Price increases were below expectations at 0.4% for October and 7.7% on a year-over-year basis. The monthly increase repeated September’s level while annual inflation fell to its lowest level since January, and 1½% below June’s recent peak.

Investors believe that the Federal Reserve’s interest rate hikes have begun to slow inflation. Consequently, the further belief is that smaller interest rate increases will be required in the future. Markets reacted with optimism when North American equity indexes posted their best trading day since 2020 by jumping 3½ to 7½% on Thursday. BLS CPI release CNBC CPI analysis CNN rate/CPI reporting

- November 30th – Federal Reserve Chair, Jerome Powell, speaks

Equity markets have been seeking indications that future interest rate increases could be lowered, and eventually slowed and then reversed. After several years of pro-business and pro-expansion interest rates, the recent rate rises have weighed heavily on domestic and global stock prices.

The indication from Chair Powell caused U.S. indexes to jump 3-4% on the last day of the month. Canada’s TSX followed the positive example set by the American indexes by moving up nearly 1%. Transcript of Powell Speech NYTimes analysis

Other factors have influence over markets (Covid resurgence in China and elsewhere, geopolitical issues like Russia’s war against Ukraine, supply chain disruptions from both Covid and hostilities, etc.), but the primary drivers have been the rate of inflation and the reaction of central banks to it.

What’s ahead for December and beyond?

The Federal Reserve’s next opportunity to raise interest rates will occur on December 14th, which is one week after the Bank of Canada’s next scheduled announcement. Both actions will affect North American investors, with Canadian equities feeling the effects of both central banks’ actions, while American stocks will be most affected by their domestic monetary policy.

On December 2nd Canadian and U.S. jobs data for November will be released, and the expected softening of labour markets in both countries supports the slowing of interest rate increases. Canadian jobs are expected to be 5,000, down from 108,000 in the prior month, and U.S. jobs are predicted at 200,000, down from 261,000. During the first seven months of 2022 about 450,000 jobs were created each month. Bloomberg Economic Calendar

The course of the pandemic and economic recovery that initiated much of the job growth in the first half of 2022 will continue to influence economic conditions. Powell also indicated in his speech the belief that a lag occurs before actions take effect and “it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down”. Many indicators are beginning to suggest the time for moderating is approaching.

Information contained in this publication has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by MRG Wealth Management Inc., or any other person or business as to its accuracy, completeness, or correctness. Nothing in this publication constitutes legal, accounting or tax advice or individually tailored investment advice. This material is prepared for general circulation and has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. This is not an offer to sell or a solicitation of an offer to buy any securities.